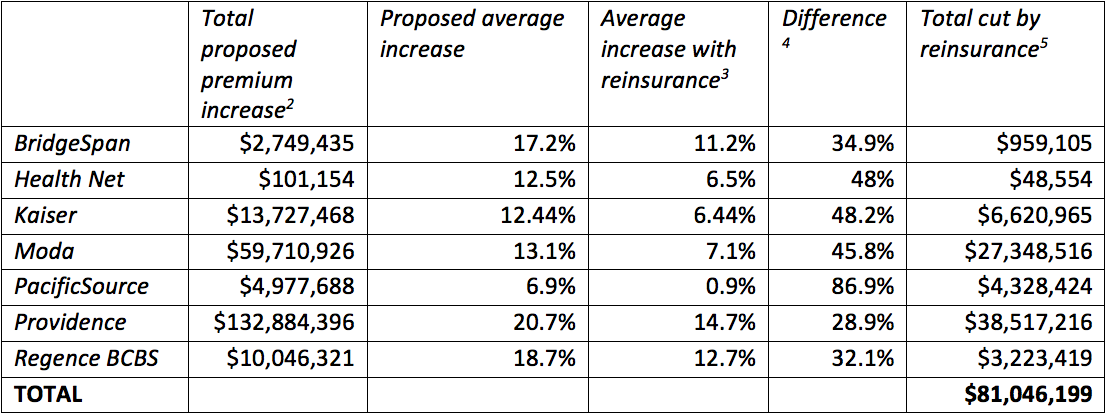

A new program could cut over $81 million from Oregon health insurance premiums—but it’s at risk

Politicians in Salem are debating whether to refer to the ballot a new program that would contain health insurance premiums for Oregon consumers. OSPIRG runs the numbers to clarify what's at stake in this debate.

Oregon consumers need no reminder that health care still costs too much and doesn’t reliably deliver a good value proposition for consumers. They’ve suffered through years of double-digit rate hikes and seen their options for affordable health coverage decrease every year. This year, with the passage of House Bill 2391, Oregon families and individuals purchasing coverage on their own could finally expect to see some relief. The bill establishes the Oregon Reinsurance Program, which OSPIRG supported, and which will help stabilize markets and contain premium increases for hundreds of thousands of consumers. [1]

But now, this program is at risk. Some politicians in Salem are proposing to refer HB 2391 to the ballot, which would put it on hold until it could be voted on. To clarify the stakes in this debate, we did a quick analysis of the impact of the program on health insurance premiums for Oregonians.

This analysis is based on data from rate increase proposals for Oregon individual health insurance plans for 2018. Oregon rate filings can be found at the Oregon Department of Consumer and Business Services’ (DCBS) user-friendly rate review website, www.oregonhealthrates.org. The increases after reinsurance are based on DCBS’s determination that the Oregon Reinsurance Program will reduce rates by 6 percentage points. [6]

To be clear, initiative referral is a time-honored element of Oregon’s democratic system, and we have no objection to the general idea of referring legislation to a vote of the people. But Oregon consumers and policymakers should recognize the high stakes in the current debate. Putting the program on hold could be very costly for Oregon consumers. With the program on hold, Oregonians may not see any of this relief from premium rate hikes next year.

This would not only cost Oregon families and individuals purchasing coverage on their own more than $81 million next year, it also runs the risk of destabilizing health insurance markets, which could reduce competition and decrease coverage options even further. Without the reinsurance program to help keep costs in check, insurers may yet again threaten to pull out of large parts of the state—leaving rural Oregonians especially at risk of having even fewer options for health coverage.

——–

NOTES

[1] HB 2391 also helps fund the Oregon Health Plan. We focus on the reinsurance program here because its profound effect on health insurance premiums has received much less attention.

[2] This the total amount of additional money the insurance company projects that its proposed premium increase would raise.

[3] This is simply the proposed average increase minus six percentage points.

[4] This is the amount by which reinsurance cuts back the proposed increase—e.g., cutting back a 17.2% increase to an 11.2% increase represents cutting the increase back by 34.9%.

[5] This is the total proposed premium increase multiplied by the difference.

[6] Learn more about how DCBS is planning to implement the reinsurance program through cutting back premium rates, and about their preliminary decisions on 2018 rates, here: http://dfr.oregon.gov/news/Pages/20170630-2018-preliminary-rates.aspx