This Earth Day, put our planet over plastic

The United States is the world's largest plastic polluter: Every year, we produce a staggering 35 million tons of plastic waste. PIRG is working to fix that -- and we need your help.

OSPIRG is an advocate for the public interest. We speak out for the public and stand up to special interests on problems that affect the public's health, safety and wellbeing.

The Latest

Costco should stop supersizing wasteful packaging

Statement: New rule will aid PFAS clean-ups

Updates

Lobby day secures bipartisan support for the Plastic Pellet Free Water Act

Stop The Overuse Of Antibiotics

Panera Bread backs off of no antibiotics policy

Energy Conservation & Efficiency

Groups urge Biden to ‘Finish the job’ on appliance efficiency

Refill, Return, Reimagine: Innovative Solutions to Reduce Wasteful Packaging

Single-use plastic packaging is so common in our everyday lives that a future without it might seem a long way off. But examples of what that future might look like are already here.

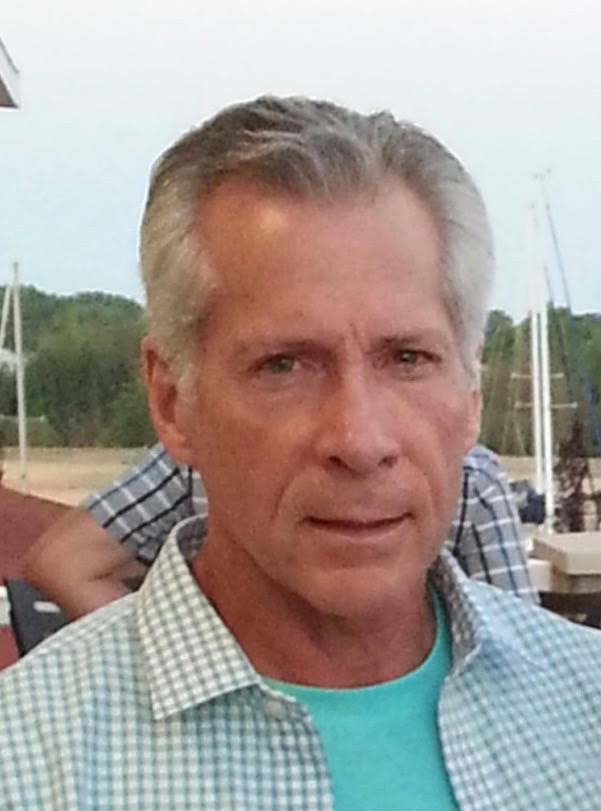

I like that PIRG digs down and finds ways the system has been rigged against our long-term welfare and tries to translate that into legislative and legal action at the state, local and national levels.Nick Bridge, Member

PIRG will keep working until the job’s done

I decided to support an organization that doesn’t seem to rely on partisan politics to accomplish goals, and as a pediatrician, I have been especially interested in OSPIRG’s projects that impact the health of children and infants...Patricia Jett, Member

I decided to support an organization that doesn’t…rely on partisan politics to accomplish goals

We have a vision to transform our transportation systemDanny Katz, Executive Director, CoPIRG

We have a vision to transform our transportation system

I greatly appreciate PIRG for fighting for a safer, healthier world.Helen M, Member

PIRG keeps me informed

I support OSPIRG for the health of the state I love.Laura V.F., Member