This New Year, Celebrate the CFPB

This month, we published our 8th report based on analyzing consumer complaints collected in the CFPB's Public Consumer Complaint Database. The release of "Big Banks, Big Overdraft Fees" provides a good year-end opportunity to summarize a few of the reasons to be thankful for the Consumer Financial Protection Bureau, which took over in July 2011 as the first federal regulator with just one job: protecting consumers from unfair financial practices. The idea of the CFPB needs no defense, only more defenders.

This month, we published our 8th PIRG report based on analyzing consumer complaints collected in the CFPB’s Public Consumer Complaint Database. We archive all of them here at our page “Reports: The CFPB Gets Results For Consumers.” Have a problem with a bank or financial company? Join over one million consumers and file a complaint with the CFPB.

The release of “Big Banks, Big Overdraft Fees” provides a good year-end opportunity to summarize a few of the reasons to be thankful for the Consumer Financial Protection Bureau, which took over in July 2011 as the first federal regulator with just one job: protecting consumers from unfair financial practices. The idea of the CFPB needs no defense, only more defenders.

Here are just a few reasons to celebrate the CFPB:

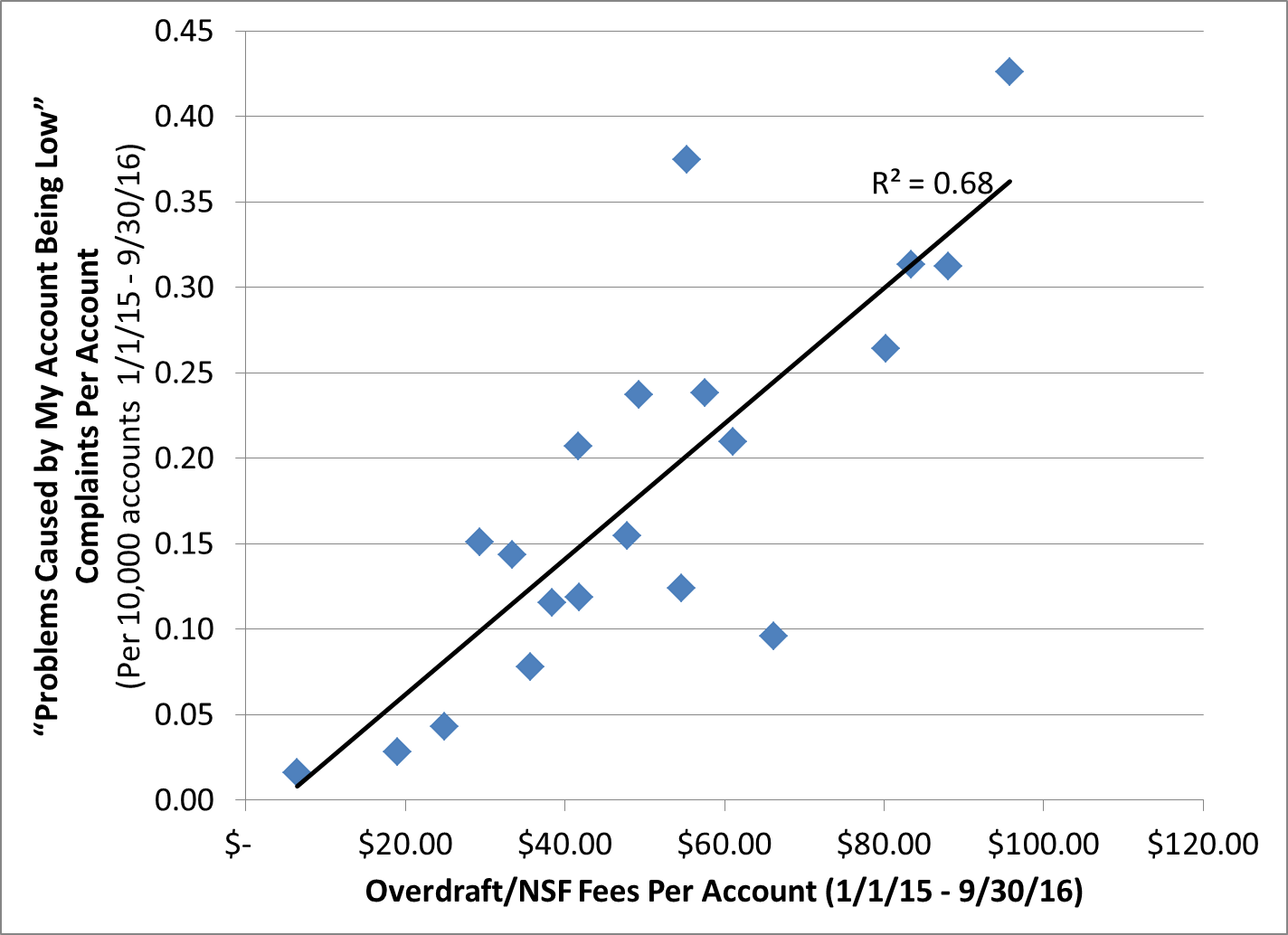

The CFPB is Cleaning Up Overdrafts: Our report (see figure left) had a key statistically-valid finding that banks that rely more heavily on overdraft revenue generated more consumer complaints to the CFPB than those that did not. That certainly supports CFPB’s important efforts to reduce unfair overdrafts as a source of revenue and to better align the products offered by regulated firms with those of their customers. Overdraft revenue is not a “product” to be proud of. In 2015, the CFPB slammed Regions Bank for illegally imposing fees on its customers. The bank was forced to return over $49 million in ill-gotten gains and pay a penalty of $7.5 million. Also in December 2016, the CFPB itself announced concerns that too many college students were paying hundreds of dollars annually in overdraft fees, often due to sketchy relationships negotiated by banks with colleges for profitable access to their students. We anticipate a new CFPB rule further restricting unfair overdraft practices in 2017. Our “how to avoid overdraft fees” tips are here.

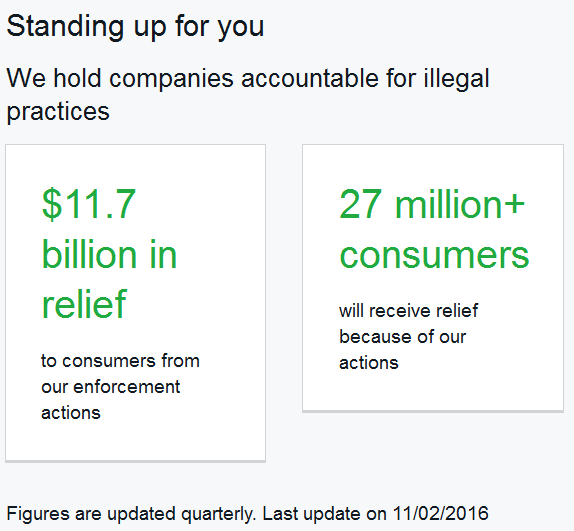

The CFPB Is Refunding Billions To Victimized Consumers: In just over 5 years of existence, the CFPB has refunded directly or otherwise negated nearly $12 billion in unfair fees and interest to 27 million consumers victimized by credit card companies, for-profit schools, debt collectors, mortgage firms, payday lenders and others. Here are a few examples of its efforts:

- In December, CFPB ordered payday lender Moneytree to repay consumers $255,000.

- In September, CFPB fined Wells Fargo Bank $100 million and ordered $2.5 million in refunds for executives allowing front-line workers to create fake accounts to meet sales goals. In November, it warned all other banks against similar mis-aligned practices, including “unauthorized opt-ins to overdraft services.”

- Also in September, CFPB ordered for-profit school chain Bridgepoint to automatically refund $23.5 million to students and former students and to pay a civil penalty of $8 million. The CFPB has taken numerous other actions to protect for-profit school victims, including securing $480 million in debt relief for students of the defunct Corinthian Colleges.

- Nearly $2 billion has been directly refunded to consumers victimized by add-on subscription products (credit monitoring, identity theft insurance, etc.) piggybacked onto their credit card bills, including this $727 million refund order against Bank of America.

- The CFPB has gone after a variety of unfair mortgage practices, including a 2015 order against RPM Mortgage for a kickback scheme that resulted in consumers being steered into higher-cost loans. It had to refund $18 million to consumers and pay a $1 million civil penalty.

The CFPB Is Conducting Research, Going On The Road and Exploring New Issues, Including Fintech: In December, the CFPB released a new research on “Credit Invisibles.” It also held its annual two-day research conference. From CFPB Director Richard Cordray’s prepared remarks:

“Consumer spending makes up about 70 percent of all economic activity. Much of that spending requires practical and sustainable methods of financing. Yet a few short years ago, many economists were blindsided when the biggest consumer financial market in the world – the U.S. mortgage market – triggered the worst financial crisis in almost a century, domestically as well as globally. For this reason alone, the field of consumer finance demands more of our attention.”

In November, I traveled to Salt Lake City to testify at a CFPB field hearing to launch an inquiry on challenges consumers may face from their banks making it harder for them to use new third-party financial tools. This was at least the 36th field hearing or town hall held around the nation by senior CFPB officials, who have also testified before Congress at least 61 times in just over five years.

The CFPB is Educating Consumers and Giving Them Financial Tools: The CFPB offers consumers, caregivers, educators, librarians and others a variety of “Know Before You Owe” tools and other tool boxes to aid in financial decisionmaking. CFPB Director Richard Cordray also sits on the U.S. FInancial Literacy and Education Commission. Here is an excerpt from his prepared remarks at its meeting in November.

“We confront many challenges in achieving our goal of financial capability for young people. These challenges are complex, varied, and significant. For those interested in more details about all of the Consumer Bureau’s various activities and strategies in this area, we have just released our Financial Literacy Annual Report for 2016.”

The CFPB Is Reining in Unfair Practices and Setting Rules For New Products: While credit and debit card consumers have long had rights, pre-paid card users had none until a new CFPB rule was finalized in October. In final stages are rules reining in high-cost predatory payday and auto title loans and restricting the use of forced arbittation clauses to deny consumers their day in court.

The CFPB is Fighting Discrimination and Protecting Students, Seniors and Military Families: CFPB has special offices for students, older Americans, military families and consumers at risk of illegal or discriminatory practices.

The Public Supports The CFPB, Overwhelmingly: An annual poll conducted for the PIRG-backed Americans for Financial Reform found in July that the public, overwhelmingly and across party lines, supported both the CFPB and continued Wall Street regulation. A December Morning Consult poll found that 56% of Trump voters either want the CFPB left alone or strengthened. Only 7% want it eliminated.

In a recent column in the Charleston (WV) Gazette, my PIRG colleague Woody Little said it well:

“The Consumer Financial Protection Bureau is the most important federal agency you have probably never heard of. Since 2011, the CFPB has served as a wildly successful and accountable watchdog over unfair and greedy practices by companies offering financial products like mortgages, student loans and credit cards.”

It’s clear that Wall Street, the payday lenders, debt collectors and their allies on Capitol Hill don’t like the CFPB. The public knows better. The idea of the CFPB needs no defense, only more defenders. Please celebrate the CFPB. It works for you.

Topics

Authors

Ed Mierzwinski

Senior Director, Federal Consumer Program, U.S. PIRG Education Fund

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

Consumer Protection Week 2024: Empowering Consumers in a Complex Marketplace

New report reveals widespread presence of plastic chemicals in our food